That equates to an overall rate of 38 of the sale price or 32500. This example assumes that when the tenant renews the tenancy the renewal terms are linked to the old tenancy.

The Web App below will assist you to calculate Stamp Duty Payable Legal Fee Payable and estimated Admin Fee Payable.

. There is no stamp duty Tax applied to the first 125000. For property in Wales use the Welsh Revenue Authoritys Land Transaction Tax calculator. Free Legal Lease Agreement Templates.

1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400. Create Your Personalised Tenancy Contract Agreement in Minutes. Variation of Lease Supplemental Agreement Stamp Duty Payable 04 of the rent for the extended period from 1 Jan 2021 31 Mar 2021 04 x 10000 x 3 120.

Stamp duty on a tenancy agreement must be paid by the tenant while. If youre buying a property in the UK you will likely need to pay some form of Stamp Duty. Iii no rent-free period.

The stamp duty for a tenancy agreement is payable by the tenant whereas the copy is payable by the landlord. Our Values Principles we live by. The threshold for non-residential land and properties is 150000.

Soccer will be responsible for proving that any gaps in pay are a result of good faith negotiation Feldman says. Book a valuation. The stamp duty is free if the annual rental is below RM2400.

This computation produces an amount known as the Net. ASB Unitholders Get Up to 700 sen Dividend. Tenancy agreement stamp duty calculator.

Buy To Let Stamp Duty Calculator. For a home priced over 500000 the standard rates of stamp duty. The landlord and tenant can include all the conditions in the tenancy agreement as long as it is legal and has been agreed by both parties.

Stamp Duty Holiday 2021. Easy Fill-in Legal Templates. Monthly rental x 12 2400 250 x rates based on tenancy period.

Customise Your Tenancy Agreement Stamp Duty Today. If your tenancy period is between 1 3 years the stamp duty fee is RM2 per RM250. Free Legal Lease Agreement Templates.

In order for the tenancy agreement to prove effective during tenure you must get it stamped at LHDN. SDLT is a tax levied on tenancy transactions paid by Tenants and is calculated on the amount of gross rent for the term of the tenancy less a pre-set discount Temporal Discount Rate currently 35. Enter the property price to find out how much stamp duty you will need to pay for buy-to let and second home purchases.

For Individuals Rights and. Dont worry calculating tenancy agreement stamp duty is pretty easy. I lease term exceeding 1 year.

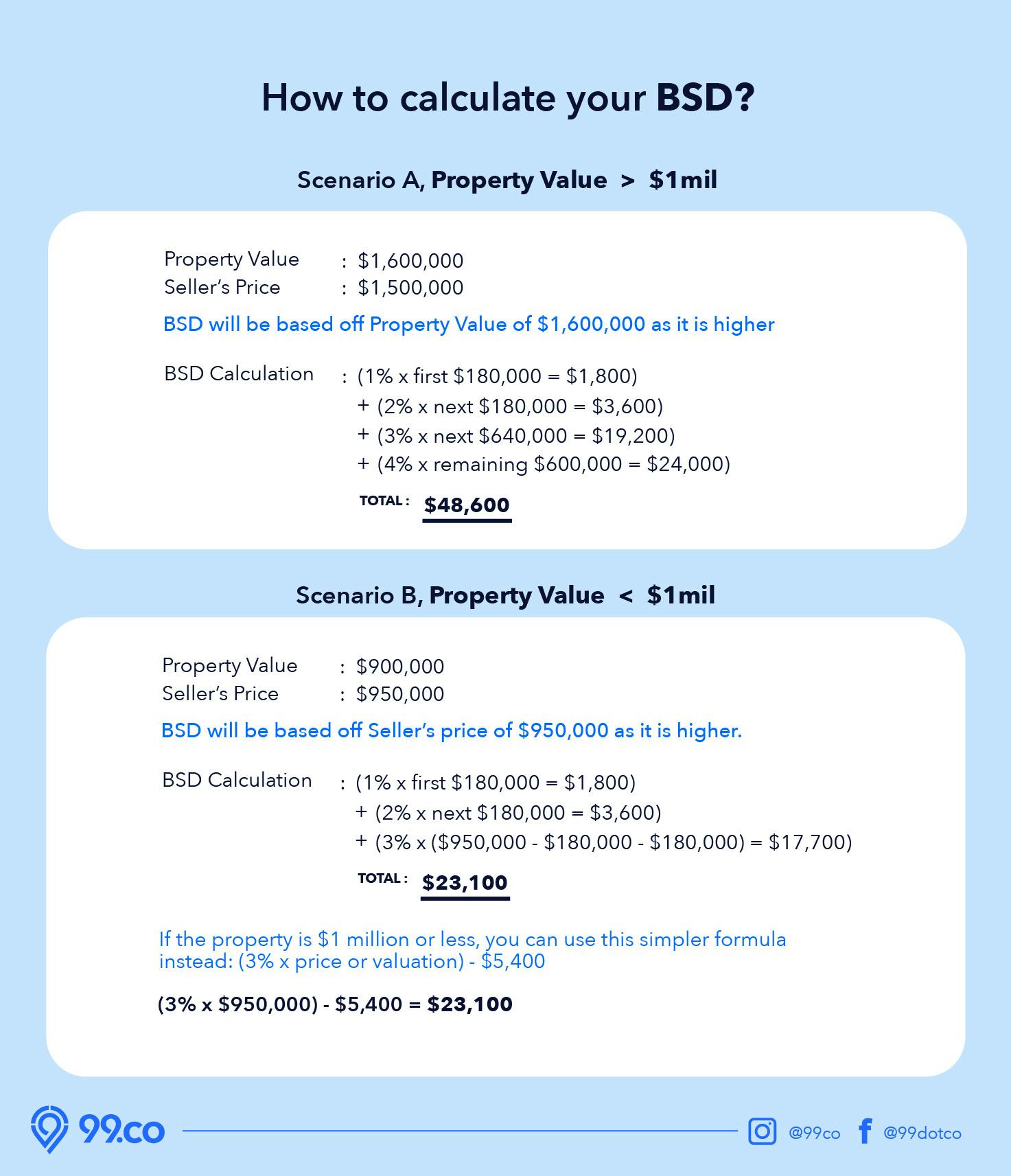

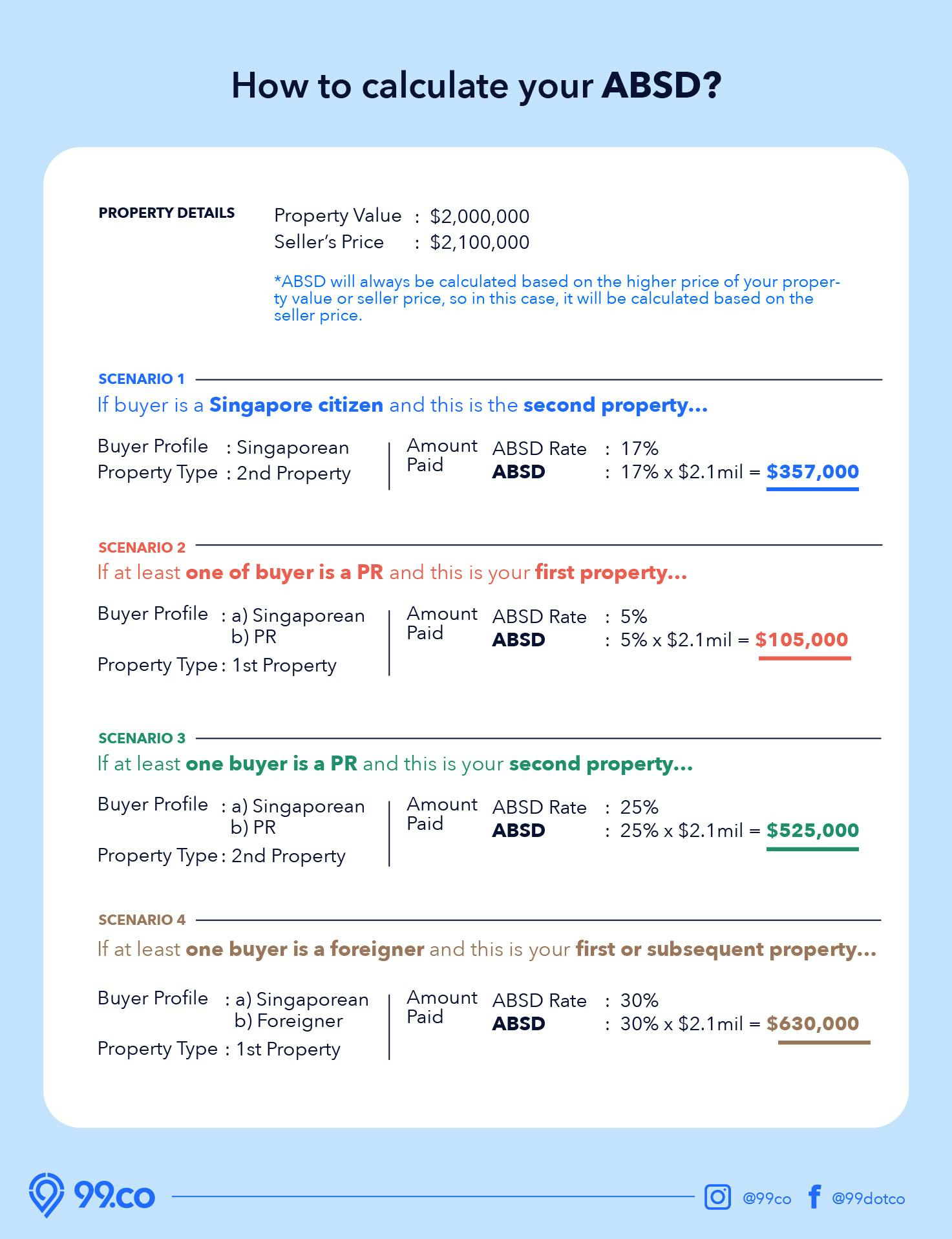

Tenancy Agreement Stamp Duty Calculator Malaysia. The stamp duty for a tenancy agreement in Malaysia is calculated as the following. Tenancy Agreement Stamp Duty Calculator.

No stamp duty is payable on the first 125000 and 2500 is payable on the 125000 portion within the next band between 125000 250000. Calculations take effect from 1st October 2021 England and Northern Ireland - SDLT Calculator. In England and Northern Ireland you pay Stamp Duty Land Tax SDLT.

SDLT due by a Tenant based on 10 years at the average London rent. If youre buying a home priced at or below 500000 youll pay 5 on the amount you spend between 300001 and 500000. For Companies Company-related topics.

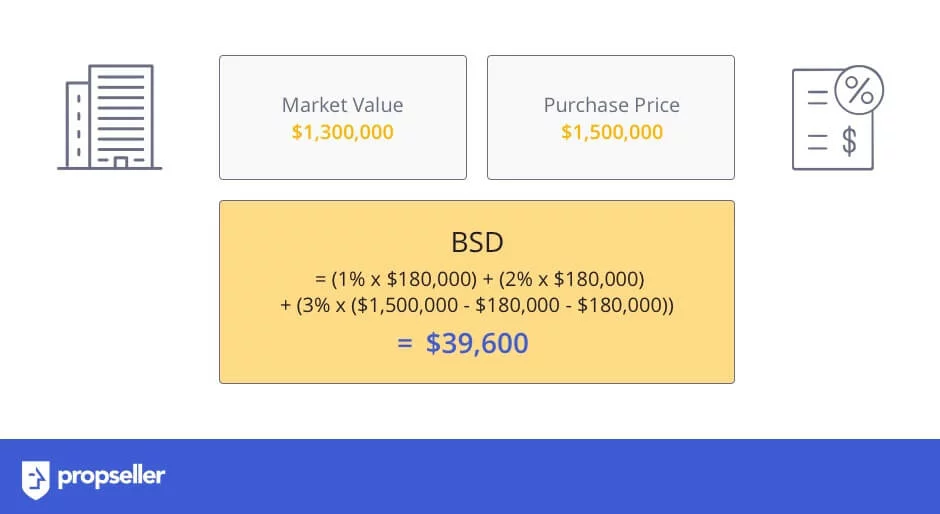

Based on the table below this means that for tenancy periods less than 1 year the stamp duty fee is RM1 per RM250. Owning residential property means holding an interest in a dwelling whether freehold or leasehold - so even if you only own part of a property or youve inherited a property these things still count as holding an interest and would mean youre not considered a first. For rates before 22 Feb 2014 please refer to Stamp Duty for Property.

The SDLT threshold was raised in March 2005 to 120000 and in March 2006 to 125000. On a property purchased for 250000 the total stamp duty payable would be 2500. The tax varies depending on where you are buying.

Remember if youre a first-time buyer you wont pay stamp duty tax on a property priced at or below 300000. Ad Create a Free Agreement Between a Tenant and a Landlord to Rent a Property. It is important to note that this is an indicator only your solicitor or tax consultant will advise you as to the actual Stamp Duty Land Tax that must be paid on completion.

To use this calculator. Fill in your monthly rental and lease period of the property in the calculator below to know how much you would need to pay for the stamping of the tenancy agreement. To make things easier let us calculate your stamp duty for you with our tenancy agreement stamp duty calculator.

Legal fees calculator to calculate legal fees and stamp duty for a Tenancy Agreement. Total cumulative rent 216000. Payable SDLT 1 910 PLUS fines which could be very significant.

To qualify for the first-time buyer stamp duty relief you must never have owned a residential property before. When we signed a tenancy agreement in Malaysia the Tenant is required to pay Stamp Duty as a form of tax to the government. For property in Scotland use Revenue Scotlands Land and Buildings Transaction Tax calculator.

Ii fixed monthly rent throughout the whole period. Total Rent paid payable over the whole Lease Term. Stamp duty whichever part of the UK youre in is calculated in bands which means you pay different rates on different portions of the property price.

Enter the monthly rental duration number of additional copies to be stamped. Legal fees calculator to calculate legal fees and stamp duty for a Tenancy Agreement. For more information about rental stamp duty you can read a.

You can calculate how much Stamp Duty youll have to pay here using our calculator. Our Vision. As the property price increases the rate of pay increases within a certain tax bracket.

If the property is under the threshold then no stamp duty needs to be paid. From 1st October 2021 the initial stamp duty threshold is 125000. The case is likely to be settled in a trial according to Feldman.

There are different stamp duty rules if you are a first-time buyer or are buying a second home or investment. Buy to let Property price 3 Up to 125000 5 125001 to 250000 8 250001 to 925000 13. To calculate the Stamp Duty that may be payable on your planned purchase simply put the purchase price into our SDLT calculator above and click calculate.

As of 3rd March 2021 the Chancellor announced an extension to the Stamp Duty holiday for all properties in England and Northern Ireland up to the. But how much will you have to pay for the stamping fee. Rental Stamp Duty Calculator helps you determine the amount of stamp duty payable to IRAS for the tenancy agreement signed.

HM Revenue and Customs HMRC has a Stamp Duty Land Tax calculator to work out how much tax is due in England or Northern Ireland. Soccer will try to make the case that the pay gap boils down to the two different collective bargaining agreements agreed to by each team under. Customise Your Tenancy Agreement Stamp Duty Today.

Understand the formula on how Stamping Fee is calculated for a. Home Calculators Tenancy Agreement Stamp Duty Calculator. Our Story Get to know us better.

For example if the threshold was 125000 you wouldnt pay any stamp duty on properties of that. Only applicable for cases with. 30000 0 90000 120000.

Round up to the nearest ringgit. Original Lease Period Rent. Liable for SDLT 91000.

Rather than a single fixed fee stamp duty for tenancy agreements are calculated based on every RM250 of the annual rental. There is no standard lease form. In Scotland it is the Land and Buildings Transaction Tax LBTT and in Wales it is the Land Transaction Tax LTT.

Tenancy Agreement Stamp Duty Calculator Malaysia. From 1 July 2021 youll get a discount relief that means youll pay less or no tax if both the. How to calculate the new stamp duty rate.

This is for any rental property that has been leased out to tenants by landlords. SDLT Rates England and Northern.

Malaysia Property Stamp Duty Calculation Don T Know How To Count Property Stamp Duty Here Is It By Sheldon Property 74 Views 0 Likes 0 Loves 0 Comments 0 Shares Facebook

Online Stamp Duty Calculator Check Latest July 2022 Rates Here

What You Need To Know About Stamp Duty For Rental Units In Singapore

Stamp Duty Calculator Queensland What Does Transfer Duty Cost In Qld

Stamp Duty Calculator Buyer Stamp Duty And Absd Calculator For Singapore 99 Co

What Is Stamp Duty How Much Do I Need To Pay The Mortgage Genie

1 Rent Agreement Leave And License Agreement 2 Tenant Police Verification Call Cura 020 60121922 Legal Services Rent Legal

Rate Of Stamp Duties In Gujarat

Stamp Duty Holiday Your Move Blog Homewise

Stamp Duty Transfer Duty What Are They And Are They The Same Blocksidge Ferguson

Ws Genesis E Stamping Services

Tenancy Agreement Stamp Duty Table Tenancy Agreement Agreement Stamp Duty

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Stamp Duty Calculator Buyer Stamp Duty And Absd Calculator For Singapore 99 Co

Horrocks Solicitors Conveyancing News In Brisbane Buying Property Digital Nomad Wonderful Places

Stamp Duty Calculator Helpful 2021 Sdlt Calculator